It has been said that technology seldom guarantees the success of an acquisition, but often guarantees its failure.

Overconfidence, lack of understanding of the intricacies of IT systems, lack of M&A experience, and let’s face it corporate hubris can lead to delays, cost overruns, squandering of technology assets, negative impact on customer service and make achieving business synergies difficult or impossible.

I’m a veteran of many acquisitions (and on both sides of a deal) ranging from a few millions to over a billion dollars. At Kapstone Paper, starting in 2007 I oversaw all the technology aspects of 5 successful acquisitions in a span of 6 years, sometimes tripling the size of the company overnight.

I will leverage this experience to help your business with:

Buying a business: you need Due Diligence!

Simply put: you don’t know what you don’t know! Unless your technology leadership have extensive experience acquiring businesses they’re likely to struggle to uncover potential risks and technology challenges until after the close, when they’re expected to deliver results. And that Big 5 accounting firm you’re thinking of bringing in to help will follow a cumbersome, boilerplate approach not aligned with your business model. Only someone who’s been in the M&A trenches can help you find out what you’re really getting into.

Are you being acquired?

Are you being acquired? Or just “prepping the bride” before selling your business? Is your IT leadership up to the task in this challenging time? Or have some jumped the boat early? Don’t assume the company buying yours know what they’re doing! Hire an experienced pro to help make this happen.

Transition & Integration Planning

Your IT team has plenty of technical and project management talent – they wouldn’t be there if they didn’t! But are they being given the proper guidance?

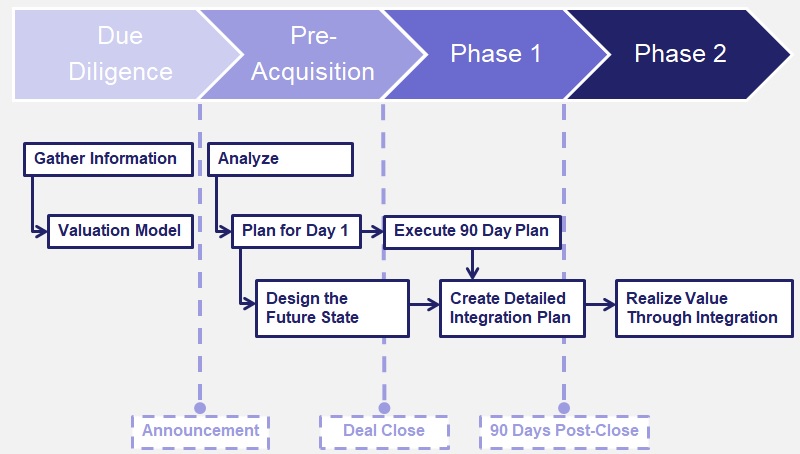

Prioritizing phases of pre- and post-close work is essential to mitigating risk and maximizing synergies:

- Day One activities: data preservation, security assessments, temporary interconnections, rebranding

- Short-term activities: financial consolidation, complete rebranding

- Phase 1 integration: office productivity platform, financials, low-hanging fruits etc.

- Phase 2 integration: ERP and main line of business apps

- Phase 3 integration: all the rest (including stuff you shouldn’t tough)

What about Divestitures?

Divestitures are deceptively easy. In practice a lots of stuff can be broken when you remove parts of your infrastructure. Licensing and contract defaults are also a significant risk. Plan your divestiture with someone who’s been through this.

Planning multiple acquisitions? You need an M&A Playbook!

If your business is planning on acquiring other businesses, you won’t want to hire consultant every time; your IT team needs a playbook on how to conduct every step from initial Due Diligence to final integration.

I developed the playbook that help a paper company from from $0 to over $3B in a few years, and can help you do the same.

Resources

McKinsey – Understanding the strategic value of IT in M&A

NearShore Blog – Why an IT M&A Playbook Is Key to Faster, Better, Cheaper Integrations

ATKearney – Winning with an IT M&A Playbook

Case Study:

KS-Victory due diligence (PCI compliance)